By Paul C. Godfrey and John Bugalla

Abstract

Risk has been a fixture in the business landscape since the beginning of time. Over the years, new techniques, such as Enterprise Risk Management (ERM), have emerged to help leaders address multiple and complicated risks, but the ability to measure and therefore manage those risks are key. Today, strategic planners face an environment where certain risks are neither calculable nor transferrable. This article defines strategic risks and proposes a new tool strategy teams can use to monitor and manage these risks to their advantage: the Strategic Uncertainty Map.

Risk has been a fixture in the business landscape since the beginning of time. The modern era of risk management began in the early 1700s when scientists, including Sir Edmund Halley of Halleys’ Comet fame, created the first actuarial tables that allowed risks to be calculated, projected, and priced. Measuring risk facilitated the growth and prosperity of a nascent insurance industry. Fast forward to the 21st century, where the world is filled with hundreds of companies that have more than US$10 billion in sales and many that have US$100 B+ stock market valuations. These organizations all have risks, but those risks have become far more complex and some can threaten an entire business model. New techniques, such as Enterprise Risk Management (ERM), have emerged to help leaders address multiple and complicated risks, but the ability to measure and therefore manage those risks are key.

Today, strategic planners face an environment where certain risks are neither calculable nor transferrable. Examples of such risks include the potential disruption to business

models by emerging technologies such as block chain or artificial intelligence (AI), the rise of political nationalism and ultra-partisanship, and the social and economic upheaval that will follow the COVID-19 pandemic. These uncertainties, what we refer to as “strategic risks,” can either torpedo or turbocharge a company’s strategic advantage. The objective of this article is to define strategic risks and propose a new tool strategy teams can use to monitor and manage these risks to their advantage.

What Are Strategic Risks?

Strategic risks are uncertainties that strike at the heart of a company’s core competitive advantage, the reason it wins in its markets. Strategic risks differ from operating ones along two key dimensions; they can’t be calculated in terms of probabilities, and, if/when they materialize, they have a broader impact on the firm. Indeed, contrary to operational risks (e.g., currency, technology risks of obsolescence, and cyberattack) that may wreak havoc on a firm’s short-term performance, strategic risks jeopardize the firms as a going concern.

Strategic risks, which are by nature unique, varied, and difficult to detect, have three common features. First, they originate in the external environment of an organization (in both private and public sectors). Put simply, someone or something outside the firm itself gives birth to strategic risks. These may be competitors who innovate, politicians who pontificate and regulate, or activists who agitate for social change. Apple’s rollout of the iPhone in 2007, for example, mortally wounded Intel’s communication business, which went from a US$10 billion business in 2007 to US$200 million in 2012. General Motors, Ford, and other major automakers may face a similar fate from the evolution of autonomous vehicle technology, depending on their response.

Second, strategic risks invite a response from senior organizational leaders, one that is either proactive or reactive. Auto executives may, for example, choose to monitor technological innovation with an eye towards adoption, or they may discount the potential impact and delay any response. Our experience is that far too often top management teams choose inaction and eventual reaction to strategic risks when they mature. In 2005, Apple approached Intel about producing a low power chip for its planned iPhone. Intel CEO Paul Ottolini, trapped in a strategy of high volume/ high margin, underestimated the eventual market opportunity, and took a pass. Intel has never recovered that business. Too many auto executives saw Tesla as a niche producer of high-end vehicles and delayed serious investment. Although they are still in the game, they are playing catch-up.

Third, strategic risks mature over time, moving from fuzzy uncertainty to clear threats or opportunities. When these risks first appear, they are shrouded in uncertainty, their evolutionary path is unclear, and the timing and sequencing of threats and opportunities is unknown. For example, the ubiquitous smartphones we use today took almost 15 years to move from the crude technological oddity of the Apple Newton (1993) to the first iPhone (2007). The origin of today’s self-driving cars is often claimed to be the DARPA technology competitions in the early 2000s; however, the notion of technology that assists drivers traces back to cruise control, which appeared shortly after World War II.

To sum up, strategic risks are what Donald Rumsfeld would have referred to as “Known Unknowns.” We may know about the general contours and possibilities of strategic uncertainties, but how they actually manifest themselves only becomes clear over time.

The Strategic Uncertainty Map

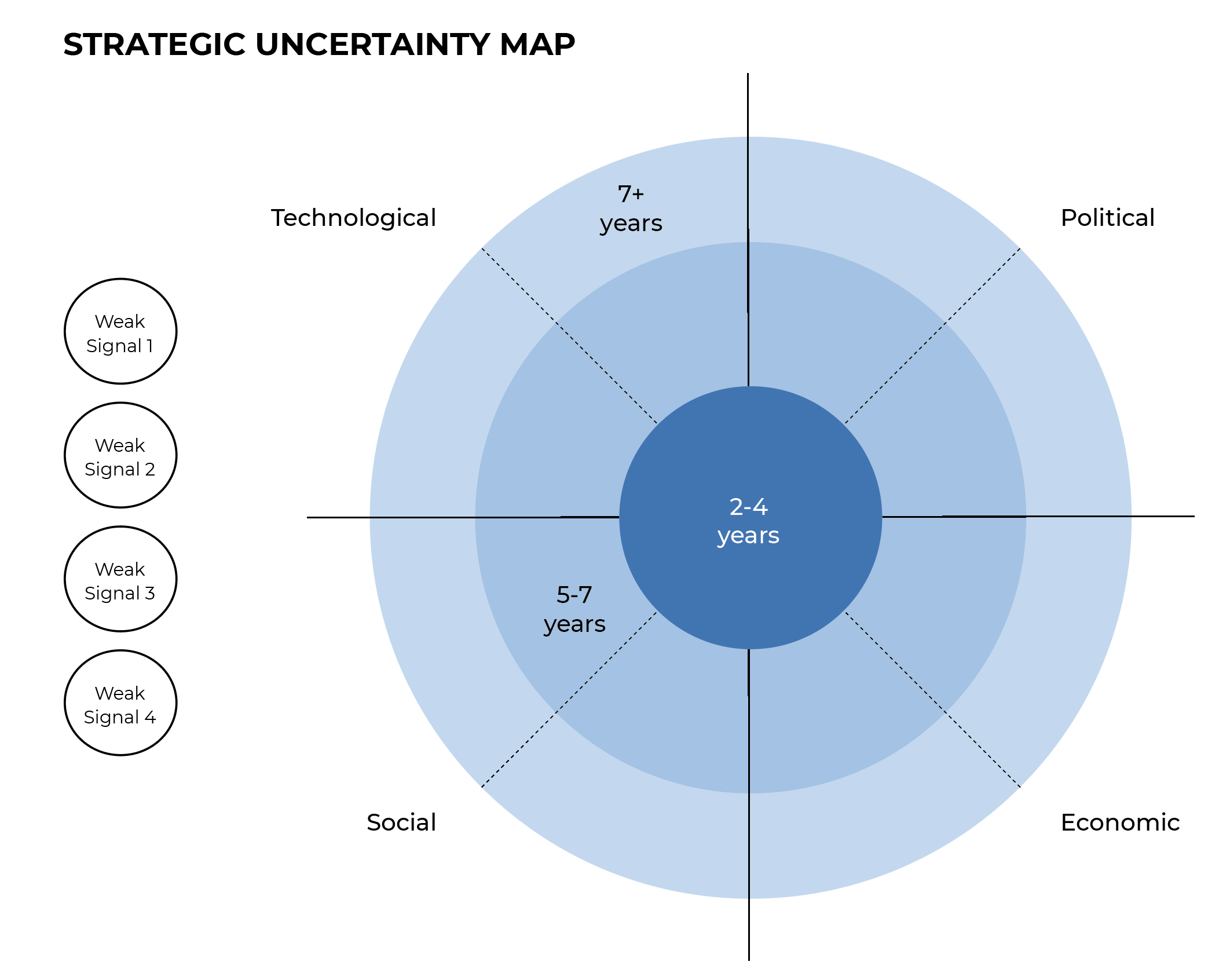

To monitor and manage these known unknowns, we advise analysts and leaders to use the Strategic Uncertainty Map. We’ve omitted the word risk from the tool to highlight that its primary purpose is to help strategists adopt a proactive response to uncertainties, while they are still evolving, rather than a reactive response to fully formed risks. The tool is best used by a dedicated team of “strategic risk analysts” within the organization, a team tasked with identifying emerging and uncertain political, economic, social, and technological trends that may impact the organization’s strategy and performance.

These teams focus on weak signals. Weak signals, a term coined by strategy guru CK Prahalad, are events, products, services, or activities that meet one or more of three criteria. First, they contradict current logic and accepted wisdom. Pre-COVID, for example, the accepted wisdom in most corporations was that on-site work facilitated close cooperation, allowed for adequate supervision and mentoring, and reinforced cultural norms and values. Some early successes with remote work a decade ago contradicted that logic and presaged the ability of many companies to maintain high levels of productivity with the entire office working from home.

Second, weak signals are outliers, offering something new and revolutionary. Apple’s original Newton was an outlier and it failed miserably. What it did, however, was signal that a hand-held computer-like device was possible.

Third, weak signals appear intermittently as they evolve and mature over time. The Newton died, and later the Palm Pilot and then the Blackberry represented quantum leaps in functionality. Had Intel attended to these weak signals, they would have seen that an innovation like the iPhone would hit a market hungry for increased mobile computing capability.

As the strategic risk team gathers information on weak signals, they create, maintain, and update a strategic uncertainty map (Figure 1). The circles on the left-hand side represent each weak signal. The four quadrants of the model help teams identify where uncertainties originate: Political moves, Social shifts, Economic adjustment, or Technological change. Placement in a quadrant “pins” an uncertainty and allows leaders to watch how the weak signal propagates throughout other quadrants as it strengthens. As strategic risks mature, they’ll tend to have impacts far beyond their original quadrant.

The concentric circles allow the team to estimate “time to impact,” for a weak signal to strengthen into a strategic risk. As risks move into the inner zone of the map, leaders can assign particular groups to develop response plans. As the map is updated, two valuable outcomes occur. First, as weak signals strengthen, the team can better estimate the time to impact for each uncertainty and move it toward the inner circle. Events like COVID-19 may dramatically change the trajectory and time to impact of already emerging trends; it has clearly accelerated a slow-moving trend toward limited remote work. Second, to emphasize our point above, weak signals tend to “wander” over time. The original “pin” in one PEST sector migrates toward other sectors as they manifest the effects of an emerging strategic risk. Mature strategic risks usually impact multiple sectors; what began as a technological innovation adds a social component or invites action in the political sphere. The uncertainty map gives the team, and the senior executives they report to, both a snapshot and a movie of potential strategic risks.

We recently used this tool in our work with a large financial services company. The team faced a host of uncertainties in their evolving business before COVID-19, and the pandemic increased the level of long-term uncertainty around their core business. Our clients found that the systematic sorting of different weak signals, and their placement on the map, helped their leaders make sense of and cope with a market environment that seemed unmanageably ambiguous. The map did not resolve their core strategic issues; however, it helped them organize a chaotic world into a more sensible, and manageable one. The map had short term value as well; it highlighted some early decisions about responding to uncertainties closest to impact, and some consideration about how distant uncertainties would impact their core strategy.

Conclusion

2020 was a year like few others in history. Strategists and executives have operated without a playbook for much of the year and have spent the last several months keeping the doors open. The trajectory of the pandemic remains uncertain, but wise teams have begun to shift their focus from survival to long-term strategic health. We see a post-pandemic world with higher levels of strategic risks, and we suggest that your organization employ the tools of strategic risk management to thrive in an increasingly risky future.

About the authors